On Fungibility and NFTs

Level 101: "What's an NFT?"

You may have heard of NFTs, wondered what the hype was about, and why some graphic images are selling for absurd amounts of money.

I wonder about that too.

I’m not going to try to explain market behavior of NFTs.

But after reading this, you will have a fundamental understanding of what “NFT” means.

The acronym NFT stands for “Non-Fungible Token”

Fungible

What does “fungible” mean? Let’s check the dictionary:

Currency is fungible. If I loan you $100, I don’t care about which $100 bill you chose to repay me with - as long as I get $100 back. You can even PayPal or Venmo me and keep it virtual.

United States dollars are fungible.

However, if I drop two of my children off at your school, at the end of the day, it’s not enough for me to get the same number of children back. I want the same children back.

Children are non-fungible.

Tokens

Let’s use Merriam-Webster again:

If you ever visited a Chuck E. Cheese restaurant before 2016, you have seen definition 1a tokens in use.

These tokens gave you turns on the obnoxiously loud arcade games placed there for the entertainment of hyped-up children and tired parents. They worked as a special-purpose currency, valid only inside the restaurant.

Bitcoin and similar cryptocurrencies work as tokens too. They are electronic tokens, not physical tokens like arcade or bus pass tokens. As a currency, it doesn’t matter which Bitcoins you have, all that matters is how much. Bitcoiners like to say “1 $BTC = 1 $BTC”

Non-Fungible Tokens

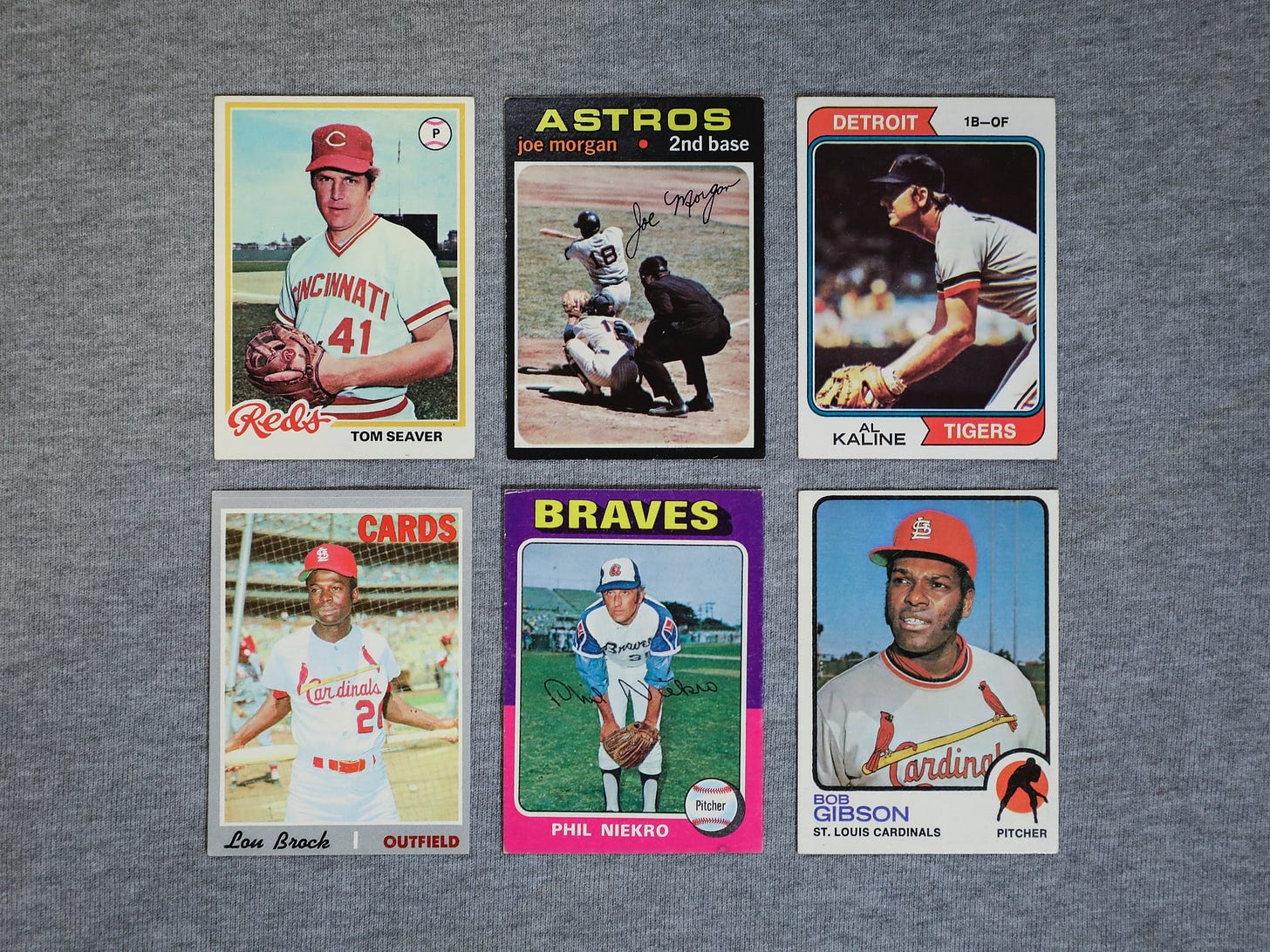

Bitcoin and Chuck E. Cheese tokens are fungible. Now let’s look at a real world, physical token that is non-fungible. Baseball cards.

Baseball cards are somewhat standardized in size and shape, but they are not fungible. Their value varies by condition, rarity, and popularity of the player.

Some are practically worthless, a few are of Honus Wagner and worth millions of dollars.

NFTs are the digital equivalent of baseball cards.

Baseball cards are physical tokens. The value in a baseball card is not the paper, but what it represents. No one pays $6.6 million for a baseball card because of the high quality of the printing.

A NTF digitizes this representation. In the same way that Bitcoin provides a way to cryptographically prove that the owner of a certain Bitcoin wallet “owns”, or “has a right to”, a certain quantity of Bitcoin, an NFT provides cryptographic proof of who owns a specific digital asset.

“Just right-click and save, lol”

A common criticism of NFTs is that they don’t prevent copying of the digital asset that is “owned”.

Let’s look at a specific example. This is Bored Ape #3562:

Bored Ape #3562 isn’t the most expensive NFT ever, but it’s high on the list. On December 28, 2021, Bored Ape #3562 sold for 430 Ξ (Ethereum) to user MachiBigBrother.

At this moment, the market price of Ethereum is $2,864.71, so that 430 Ξ is $1,231,825.30.1

What stops me from screenshotting this handsome yet droll fellow and using his image?

Nothing whatsoever.2

While this is true, it misses the point.

Consider the Honus Wagner baseball card. The internet is full of images of the Honus Wagner card. See for yourself.

None of those images will ever be auctioned off for millions of dollars. Only the genuine token matters.

Similarly, I can scroll through the Bored Apes collection and right-click-save or screenshot all I want. My result will be a bunch of images of no value. No one is going to auction my saved copies of the image. Why? Because only the genuine token matters. If I want to buy Bored Ape #3562, I need to come to an agreement with MachiBigBrother, whoever that is.

Conclusion

Now you have a high-level, non-technical explanation of NFTs.

This is only the beginning. The fundamental concepts of NFTs are simple, but the topic is huge. Please post your questions, and I’ll do my best to answer.

By the time you read this, Ethereum will have a new market price.

Besides copyright law, of course. The owner of the Bored Ape NFT owns the intellectual property of the image, so standard Internet recourses about pirated content apply.